THE NEXT QUESTIONS ARE BASED ON THE FOLLOWING INFORMATION:

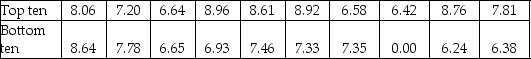

From the top 1000 companies in valuation,a comparison of the mean dividend yield of the top and bottom ten electric utility companies is desired.Let 1 = top ten,and 2 = bottom ten,electric utility companies respectively.The data shown below are for two independent samples,which are drawn at random from populations that are normally distributed.

-Use Excel or Minitab to summarize the data using descriptive statistics.

Definitions:

Les Très Riches Heures

An illuminated manuscript book of hours, considered one of the masterpieces of the International Gothic period, made in France for the Duke of Berry.

Portinari Altarpiece

A celebrated triptych painted by Hugo van der Goes, representing a religious scene, notable for its detailed portrayal of the Portinari family and extensive symbolic elements.

Hugo Van Der Goes

A Northern Renaissance painter from the Netherlands, best known for his work "The Adoration of the Kings" and contributions to the development of realistic portraiture and landscapes.

Dieric Bouts

A Dutch painter who was active in the 15th century, known for his religious scenes and for his role in the development of the Early Netherlandish painting style.

Q8: Determine the reliability factor from the Student's

Q15: The numerator and denominator degrees of freedom

Q27: A university vice president for academic affairs

Q80: The value of the coefficient of determination

Q82: The estimation procedure used to compare two

Q103: What is the sample variance of the

Q137: Develop a scatter diagram for these data.

Q173: Calculate the standard error of estimate.<br>A)0)66<br>B)0)76<br>C)0)85<br>D)0)61

Q177: The regression sum of squares (SSR)can never

Q222: Calculate the unbiased estimate of error variance.