THE NEXT QUESTIONS ARE BASED ON THE FOLLOWING INFORMATION:

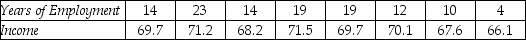

You are interested in exploring the relationship between the income of professors (measured in thousands of dollars)and the number of years they have been employed by the university.You collect the following data from eight professors.

-Use a computer to run the simple linear regression analysis of income on length of employment.

Definitions:

Macaulay Duration

A measure of the weighted average time until a bond's cash flows are paid back, used to assess interest rate risk.

Yield To Maturity

The total return anticipated on a bond if held until it matures.

Interest-Rate Risk

The risk that an investment's value will change due to a change in the absolute level of interest rates, affecting debt securities inversely with respect to their prices and yields.

Unsystematic Risk

The portion of total risk that is specific to a single investment or to a small group of investments, also known as idiosyncratic or specific risk, which can be mitigated through diversification.

Q6: How would you interpret the coefficient on

Q9: A null hypothesis of the difference between

Q15: If the value of the Durbin-Watson statistic

Q30: Test the hypothesis that there was no

Q40: Models in which the error terms do

Q87: When measuring experimental outcomes,a(n)_ variable represents a

Q92: The test for the equality of two

Q100: Determine the regression coefficient of the y-intercept.<br>A)112.4<br>B)102.3<br>C)108.6<br>D)105.5

Q176: Consider the following statistics of a multiple

Q202: As you add irrelevant independent variables to