THE NEXT QUESTIONS ARE BASED ON THE FOLLOWING INFORMATION:

For a sample of 20 monthly observations a financial analyst wants to regress the percentage rate of return (y)of the common stock of a corporation on the percentage rate of return (x)of the Standard and Poor's 500 Index.The following summary statistics are available:

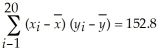

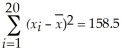

,

,

,and

-Estimate the linear regression of y on x.

Definitions:

Average Total Cost

The total cost divided by the quantity produced, representing the cost of producing each unit of output.

Long Run

A period in which all factors of production and costs are variable, allowing full adjustment to changes.

Demand Equals

A state in a market where the quantity of a good or service desired by buyers is equal to the quantity supplied by sellers, resulting in market equilibrium.

Marginal Cost

The added expenditure resulting from creating an additional product or service unit.

Q5: What is the p-value for this test?<br>A)0.9965<br>B)0.1977<br>C)0.0485<br>D)0.6293<br>

Q24: Differentiate between a one-sided and two-sided composite

Q35: In testing for the differences between the

Q46: Why is it important to consider all

Q49: For a sample of 500 college professors,the

Q55: Test the company's claim at the 5%

Q69: If the p-value of a two-sided test

Q70: Determine the least squares regression line.<br>A) <img

Q109: The value of the test statistic is:<br>A)2.086<br>B)1.444<br>C)-2.086<br>D)-1.444<br>

Q140: Develop a scatter diagram for the data.Does