THE NEXT QUESTIONS ARE BASED ON THE FOLLOWING INFORMATION:

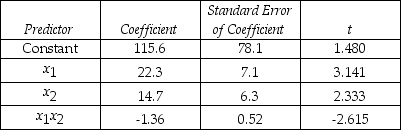

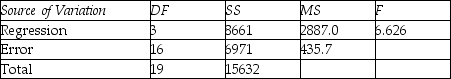

An economist is in the process of developing a model to predict the price of gold.She believes that the two most important variables are the price of a barrel of oil (x1)and the interest rate (x2).She proposes the model y = β0 + β1x1 + β2x2 + β3x1x3 + ε.A random sample of 20 daily observations was taken.The computer output is shown below.

THE REGRESSION EQUATION IS

y = 115.6 + 22.3x1 + 14.7x2 - 1.36x1x2

S = 20.9 R-Sq = 55.4%

ANALYSIS OF VARIANCE

-Is there sufficient evidence at the 1% significance level to conclude that the interest rate and the price of gold are linearly related?

Definitions:

Squared Deviations

The squared differences between individual values and the mean of a dataset, used in statistical analysis to measure variance.

Scatter Diagram

A visual depiction employing points to illustrate the connection between two numerical variables.

Cov(X,Y)

The covariance between two variables X and Y, measuring how changes in one variable are associated with changes in the other.

Sample Slope Coefficient

A parameter in a linear regression equation that represents the change in the dependent variable for a one-unit change in the independent variable.

Q18: Test at the 5% level,against the obvious

Q35: The value of the dependent variable in

Q43: Traditionally,a professor likes to assign grades according

Q68: A two-way table used for a test

Q108: What is the total degrees of freedom

Q114: In a multiple regression model,there are six

Q138: To determine whether a single coin is

Q143: A chi-square goodness-of-fit-test is to be performed.If

Q211: In a chi-square test of a contingency

Q224: Admissions at a local university have traditionally