THE NEXT QUESTIONS ARE BASED ON THE FOLLOWING INFORMATION:

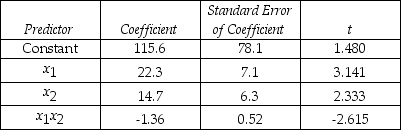

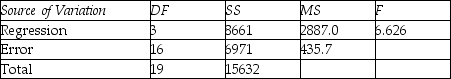

An economist is in the process of developing a model to predict the price of gold.She believes that the two most important variables are the price of a barrel of oil (x1)and the interest rate (x2).She proposes the model y = β0 + β1x1 + β2x2 + β3x1x3 + ε.A random sample of 20 daily observations was taken.The computer output is shown below.

THE REGRESSION EQUATION IS

y = 115.6 + 22.3x1 + 14.7x2 - 1.36x1x2

S = 20.9 R-Sq = 55.4%

ANALYSIS OF VARIANCE

-Is there sufficient evidence at the 1% significance level to conclude that the price of a barrel of oil and the price of gold are linearly related?

Definitions:

Cash Inflows

The total amount of money being transferred into a company, typically from operations, financing, or investing activities.

Net Cash Inflows

The total amount of cash received by a company during a specific period, minus the total amount of cash outflows.

Payback Period

The length of time required to recover the cost of an investment, calculated by dividing the initial investment by the annual cash inflow.

Discount Rate

The interest rate used to discount future cash flows to their present value, reflecting the time value of money and risk.

Q21: Consider the regression model <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2968/.jpg" alt="Consider

Q29: In an ANOVA analysis with K number

Q79: Which of the following statements about nonparametric

Q89: Write the model specification and define the

Q114: In a multiple regression model,there are six

Q135: Skewness provides a measure of the weight

Q139: When the errors in a regression model

Q158: What is the calculated value of the

Q185: Compute the coefficient b<sub>2</sub>.

Q223: If a sample of 12 observations is