THE NEXT QUESTIONS ARE BASED ON THE FOLLOWING INFORMATION:

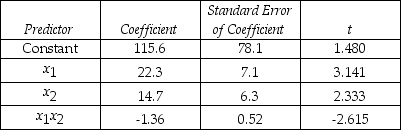

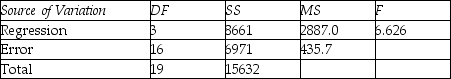

An economist is in the process of developing a model to predict the price of gold.She believes that the two most important variables are the price of a barrel of oil (x1)and the interest rate (x2).She proposes the model y = β0 + β1x1 + β2x2 + β3x1x3 + ε.A random sample of 20 daily observations was taken.The computer output is shown below.

THE REGRESSION EQUATION IS

y = 115.6 + 22.3x1 + 14.7x2 - 1.36x1x2

S = 20.9 R-Sq = 55.4%

ANALYSIS OF VARIANCE

-An economist estimates the regression model yi= β0 + β1x1i + β2x2i + εi.The estimates of the parameters β1 and β2 are not very large compared with their respective standard errors.But the size of the coefficient of determination indicates quite a strong relationship between the dependent variable and the pair of independent variables.Having obtained these results,the economist strongly suspects the presence of multicollinearity.Since his chief interest is in the influence of X1 on the dependent variable,he decides that he will avoid the problem of multicollinearity by regressing Y on X1 alone.Comment on this strategy.

Definitions:

Quantity of Money

The accumulated total of monetary resources in an economy at a certain point in time.

Price Level

An index that measures the average of current prices across a wide range of goods and services compared to a base year.

Money Market

A sector of the financial market in which financial instruments with high liquidity and short maturities are traded.

Rate of Interest

The rate of interest is the percentage at which interest is charged or paid for the use of money, typically expressed as an annual percentage rate.

Q4: What value should replace "C"?<br>A)12<br>B)9<br>C)6<br>D)3

Q9: The Mann-Whitney U test and Wilcoxon rank

Q21: The time-series model X<sub>t</sub> = T<sub>t</sub> ×

Q64: The management of a local hotel is

Q67: Test the hypothesis H<sub>0</sub> : β<sub>3</sub> =

Q78: In multiple regression analysis,when the independent variables

Q86: When x<sub>1</sub> increases by 5,what is the

Q117: Test the model for autocorrelated errors.

Q187: Is there enough evidence at the 5%

Q214: Discuss the conceptual basis of using a