THE NEXT QUESTIONS ARE BASED ON THE FOLLOWING INFORMATION:

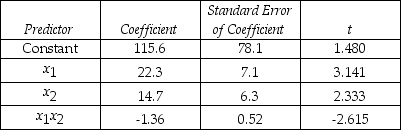

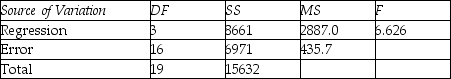

An economist is in the process of developing a model to predict the price of gold.She believes that the two most important variables are the price of a barrel of oil (x1)and the interest rate (x2).She proposes the model y = β0 + β1x1 + β2x2 + β3x1x3 + ε.A random sample of 20 daily observations was taken.The computer output is shown below.

THE REGRESSION EQUATION IS

y = 115.6 + 22.3x1 + 14.7x2 - 1.36x1x2

S = 20.9 R-Sq = 55.4%

ANALYSIS OF VARIANCE

-In the regression model Y = β0 + β2X1 + β2X2 + ε,the extent of any multicollinearity can be evaluated by finding the correlation between X2 and X2 in the sample.Explain why this is so.

Definitions:

Pay To

A directive on checks or drafts indicating to whom the payment is to be made.

Insurer's Name

Refers to the legal name of the company or entity which provides insurance coverage to policyholders.

Order Instrument

A financial document that is payable to a specific person or entity named on the document, necessitating endorsement for transfer.

Specific Payee

indicates a person or entity named explicitly in a negotiable instrument as the recipient of the payment.

Q9: The Mann-Whitney U test and Wilcoxon rank

Q24: Determine the value of <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2968/.jpg" alt="Determine

Q25: The sign test can be used to

Q46: If the number n of non-zero sample

Q97: What is the conclusion?

Q125: Is there evidence that the students did

Q136: The Kruskal-Wallis test for the difference in

Q163: The two regressions Y = β<sub>0</sub> +

Q176: Consider the following statistics of a multiple

Q194: In goodness-of-fit-test,the expected frequencies are based on