THE NEXT QUESTIONS ARE BASED ON THE FOLLOWING INFORMATION:

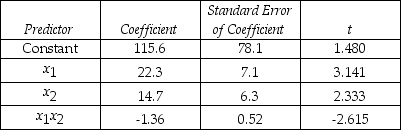

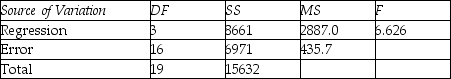

An economist is in the process of developing a model to predict the price of gold.She believes that the two most important variables are the price of a barrel of oil (x1)and the interest rate (x2).She proposes the model y = β0 + β1x1 + β2x2 + β3x1x3 + ε.A random sample of 20 daily observations was taken.The computer output is shown below.

THE REGRESSION EQUATION IS

y = 115.6 + 22.3x1 + 14.7x2 - 1.36x1x2

S = 20.9 R-Sq = 55.4%

ANALYSIS OF VARIANCE

-Suppose that a regression relationship is given by Y = β0 + β1X1 + β2X2 + ε.If the simple linear regression of Y on X1 is estimated from a sample of n observations,the resulting slope estimate will generally be biased for β1.But if the sample correlation between X1 and X2 is 0,the slope will not be biased for β1.

How does X2 affect β1 if the sample correlation between X1 and X2 is zero?

Definitions:

Continuation

The process of extending or carrying on an activity without interruption.

Undiscounted Sum

The total of all future cash flows associated with an investment or project without adjusting them for their present value.

Discounted

The method of calculating the current value of a future sum of money or series of cash flows using a particular return rate.

Interest Expense

The financial charges a company bears for loaned money across a time frame.

Q13: Which of the following tests can be

Q81: Determine the price that an individual has

Q89: Which of the following is the value

Q108: _ occurs when errors are not independently

Q121: What are the model constant and the

Q147: Compute the mean squares between blocks.

Q155: In a normal approximation to the Wilcoxon

Q175: At the 0.05 level of significance,test the

Q176: The procedure for the Wilcoxon rank sum

Q221: Test the null hypothesis that β<sub>2</sub> is