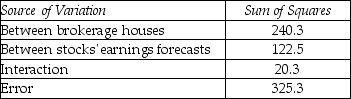

THE NEXT QUESTIONS ARE BASED ON THE FOLLOWING INFORMATION:

Four different brokerage houses were asked for stocks' earnings forecasts for the next year for five different corporations.The brokerage houses asked the analysts on staff who had experience with the corporations in question.Four analysts were surveyed at each brokerage house.Some descriptive statistics are listed below:

-Is there sufficient evidence to reject the null hypothesis that there is no difference between the stocks' earning forecasts? Use α = 0.05.

Definitions:

Pro Forma Income Statement

A financial statement that projects the future income and expenses of a company, often used for forecasting or budgeting purposes.

Common-Size Statement

A standardized financial statement presenting all items in percentage terms. Statement of financial position is shown as a percentage of assets and income statement as a percentage of sales.

Sustainable Growth Rate

The maximum rate at which a company can grow its earnings, dividends, and sales without having to increase its equity or take on new debt.

External Financing

Funds raised from sources outside of the company, such as loans, investors, or grants, to support business activities.

Q7: Patricia owns a small electronics store in

Q29: In an ANOVA analysis with K number

Q32: Stratified random sampling is an example of

Q36: Since sample members are geographically close to

Q65: Test whether the students did better on

Q76: A chi-square test for independence with 8

Q103: Assuming a smoothing constant of 0.8,find the

Q124: A chi-square test for independence with 10

Q133: Plot the series and the moving averages

Q172: In a normal approximation to the sign