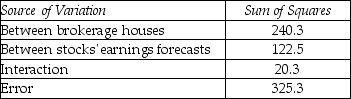

THE NEXT QUESTIONS ARE BASED ON THE FOLLOWING INFORMATION:

Four different brokerage houses were asked for stocks' earnings forecasts for the next year for five different corporations.The brokerage houses asked the analysts on staff who had experience with the corporations in question.Four analysts were surveyed at each brokerage house.Some descriptive statistics are listed below:

-Is there sufficient evidence to reject the null hypothesis that there is no interaction between brokerage houses and stocks' earning forecasts? Use α = 0.05.

Definitions:

American Put Options

Contracts that give the holder the right, but not the obligation, to sell a specified amount of an underlying security at a specified price within a specified time period.

European Puts

Options contracts giving the holder the right, but not the obligation, to sell a specific amount of an underlying asset at a predetermined price within a specified time frame.

Black-Scholes Model

A mathematical model used to price European options, factoring in stock volatility and time to expiration.

Deteriorated Performance

A decline in the operational or financial outcomes of an individual, organization, system or asset.

Q37: Which of the following components in the

Q50: If we could characterize time series primarily

Q69: A university,an inner city health clinic,and a

Q74: Is there sufficient evidence to reject the

Q75: Calculate the spearman rank correlation coefficient using

Q83: Set out the analysis of variance table.

Q90: With advertising held fixed,what would be the

Q94: Complete the ANOVA table.

Q127: For tests of independence,the expected frequencies depend

Q205: One disadvantage of the sign test is