THE NEXT QUESTIONS ARE BASED ON THE FOLLOWING INFORMATION:

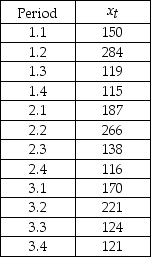

Consider the following quarterly time series data.

-Develop a seasonal index for this time series.

Definitions:

Debt Securities

Financial instruments representing a loan made by the investor to the issuer which may include bonds, notes, and bills.

Market Value

The current price at which an asset or service can be bought or sold in a public market, often determined by supply and demand dynamics.

Available-For-Sale

A classification for financial assets indicating that they are available for sale before maturity or when they are not classified in other categories.

Brokerage Fees

Charges imposed by a broker for facilitating transactions such as purchases, sales, and advice on these transactions.

Q20: The value of the test statistic F

Q30: What are the possible consequences of a

Q42: Find a 90% confidence interval for the

Q58: The Wilcoxon signed rank test provides a

Q58: Calculate the Kruskal-Wallis test statistic.

Q63: Determine the error term that corresponds to

Q64: What is the value of "E"?<br>A)484.67<br>B)727.00<br>C)246.33<br>D)198.83

Q104: Pilar's daughter wants a Betty the Builder

Q111: What is the approximate value of skewness?<br>A)0.049<br>B)0.221<br>C)1.375<br>D)1.173<br>

Q164: What are the appropriate degrees of freedom?