THE NEXT QUESTIONS ARE BASED ON THE FOLLOWING INFORMATION:

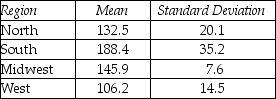

A supermarket chain has 25 stores in the North,30 in the South,50 in the Midwest,and 35 in the West.Using a proportional allocation of a random sample of 30% of the outlets,the manager records the following means and standard deviations.

-Estimate the total sales for the corporation based on these estimates.

Definitions:

SML

The Security Market Line (SML) is a line that represents the risk-return relationship of the market at a given time, as described in the Capital Asset Pricing Model (CAPM).

T-Bill Rate

The T-Bill rate is the yield on U.S. Treasury bills, a benchmark for short-term interest rates in the United States.

Portfolio Beta

A measure of the overall volatility or risk of an investment portfolio in relation to the market as a whole.

Beta

A measure of a stock's volatility in relation to the overall market, indicating its risk compared to the market average.

Q5: Determine how many sample observations are needed

Q18: Find a 95% confidence interval for the

Q22: Imagine you just started a landscaping business

Q24: Why did the FTC block the merger

Q40: The method of moving averages is used

Q63: When the supply curve and the demand

Q86: Which of the following problems is potentially

Q87: Situational ethics was considered very controversial when

Q125: Is there evidence that the students did

Q238: Whenever the expected frequency of a cell