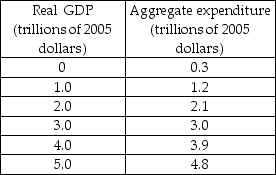

-In the above table, suppose investment decreases by $0.1 trillion. The multiplier equals

Definitions:

Net Present Value

A method used in capital budgeting to assess the profitability of an investment, calculated by subtracting the present value of cash outflows from the present value of cash inflows.

Total Value

The combined market value of all the assets owned by an entity.

Optimal Capital Structure

The best mix of debt and equity financing that minimizes a company's cost of capital and maximizes its stock price.

Debt-Equity Ratio

A financial tool measuring the blend of debt and equity financing a company utilizes for its assets.

Q16: As disposable income increases,consumption expenditures<br>A) increase by

Q158: Which school of thought believes that recessions

Q161: The government estimates that the fiscal policy

Q198: Based on the table above,<br>a) What is

Q209: The government estimates that the fiscal policy

Q239: Suppose oil prices rise.The Fed can _

Q287: A movement along the consumption function to

Q330: Consider a BMW automobile plant. If the

Q336: The slope of the aggregate expenditure curve

Q440: The equilibrium in the above figure is