Use the "Nolan" case study information to answer the questions that follow.

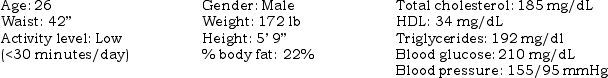

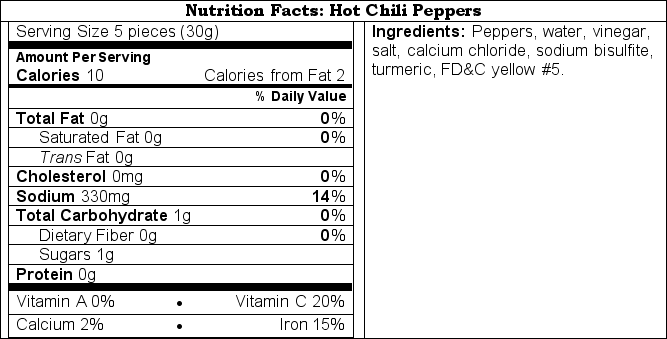

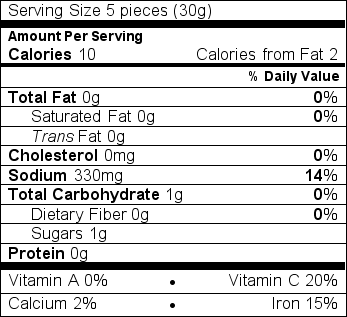

Marla is a college student with a minor in nutrition.Her friend Nolan (of Western European descent) went to her for dietary advice.Marla began assessing Nolan's overall health by determining his age,height,weight,% body fat,waist measurement,blood pressure,and fasting blood sugar and lipid levels.She then analyzed Nolan's fast and processed food-based diet for one day.Nolan tells Marla that his wife is pregnant and he is concerned about her diet.She was just diagnosed with gestational diabetes and has been craving hot chili peppers.Marla had recently read an article published in Nutrition Today,a refereed journal.The article talked about dietary issues for pregnant women.It included the results of an intervention study with an experimental and control group design and was written by N.Osman,M.D.and J.Edwards,R.D.Following are the case study information for Nolan and the food label for the hot chili peppers that his wife has been eating.

Personal Information:

One-Day Diet:

One-Day Diet:

Breakfast: 2 cups iron-fortified puffed rice cereal;0.75 cups 2% milk;2 cups coffee;2 tablespoons sugar;2 tablespoons cream;1 banana.

Lunch: Double bacon cheeseburger;1 regular vanilla milkshake;1 regular onion rings.

Snack: 3 chocolate chip cookies;2 cups 2% milk.

Dinner: 2 cups pasta;1 cup spaghetti sauce;3 oz hamburger;3 light beers.

Partial Diet Analysis:

(Note: Nolan's EER is 2843 Calories and his energy expenditure was 2850 Calories)

Carbohydrate: 314 g digestible starch,130 g simple sugars,14 g fiber,34 g alcohol

FAT: 124 g (60 g SFA;45 g MUFA;19 g PUFA)

PRO: 139 g

Calcium: 1686 mg

Phosphorus: 1618 mg

Vitamin A: 901 μg

Vitamin E: 7.2 mg

Folate: 198 µg

Vitamin C: 47 mg

Iron: 45.5 mg

Sodium: 4484 mg

-Approximately what percent of Calories came from fat in Nolan's diet? Does this comply with the AMDR?

Definitions:

Casualty Loss

A loss resulting from sudden, unexpected, or unusual events such as accidents, natural disasters, or theft, often deductible for tax purposes.

Net Sales

The financial income a business earns from sales activities, minus the deductions for returns, damaged or lost items allowances, and discounts.

Gross Profit

The financial gain obtained after deducting the cost of goods sold from total sales revenue.

Income from Operations

The profit realized from a business's ongoing operations, calculating the difference between revenues from operations and operational expenses.

Q8: Under the Sarbanes-Oxley (SOX)obstruction of justice provision,auditors

Q11: Which of the following food additive categories

Q19: Among the guidelines for balancing the interests

Q23: Which of the following intentional food additives

Q30: Within the past five years,the U.S Supreme

Q33: The law could best be described as:<br>A)only

Q33: Which of the following antibodies would most

Q54: Which of the following statements is true

Q56: Careless actions that result in injuries to

Q104: Vitamins D and K are beneficial for