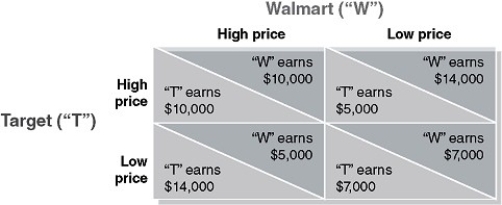

Table 11-7

Table 11-7 shows the payoff matrix for Walmart and Target from every combination of pricing strategies for the popular PlayStation 4. At the start of the game each firm charges a low price and each earns a profit of $7,000.

Table 11-7 shows the payoff matrix for Walmart and Target from every combination of pricing strategies for the popular PlayStation 4. At the start of the game each firm charges a low price and each earns a profit of $7,000.

-Refer to Table 11-7.Is the current strategy in which each firm charges the low price and earns a profit of $7,000 a Nash equilibrium? If not,why and what is the Nash equilibrium?

Definitions:

Cost of Debt

The effective interest rate a company pays on its debts, a key component in the calculation of a firm’s cost of capital.

Risk Premium

The excess return required from an investment in a risky asset over a risk-free investment.

Flotation Costs

The costs associated with issuing new securities, including underwriting, legal, registration, and other expenses.

Securities

Investment assets that denote a shareholding in a publicly-listed company (stock), a bondholder’s claim against a corporation or government, or ownership rights as outlined in an option contract.

Q15: According to the text,economists consider full employment

Q35: Refer to Table 10-4.What is the amount

Q42: When an oligopoly is in a Nash

Q73: For a downward-sloping demand curve,the marginal revenue

Q82: The largest component of spending in GDP

Q90: If the number of unemployed workers is

Q116: Refer to Table 11-6.What is the Nash

Q132: In the circular flow diagram,the value of

Q170: If GDP calculations included measurements of pollution

Q269: Why are laws aimed at regulating monopolies