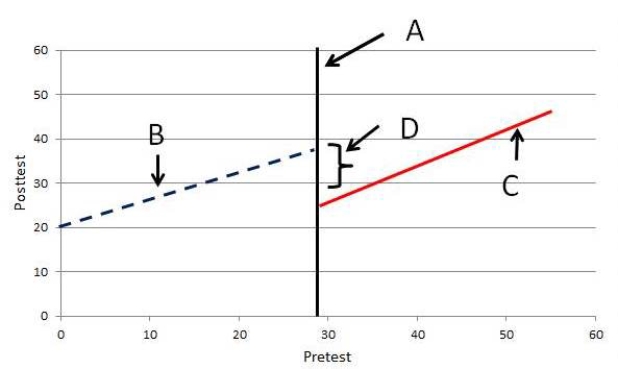

Figure TB 10-14 -Consider the Accompanying Figure,illustrating the Regression Discontinuity Design.What Is Shown

Figure TB 10-14

-Consider the accompanying figure,illustrating the regression discontinuity design.What is shown by B?

Definitions:

Bad Debts Expense

An expense reported on the income statement, representing the money lost by a business from non-recoverable credit sales.

Temporary Differences

Differences between the carrying amount of assets or liabilities and their tax bases, which will result in taxable or deductible amounts in the future.

Permanent Differences

Permanent differences are disparities between taxable income and accounting income that arise from certain transactions and events, which will not reverse in the future.

Deferred Tax Assets

Future tax benefits arising from situations where the amount of taxes paid on financial statements exceeds the amount owed for tax purposes, which can be used to reduce future tax liability.

Q7: James is a clinical researcher who is

Q17: Explain the proximal similarity model with an

Q24: The Buros Center for Testing at the

Q24: What type of samples are selected on

Q32: If there are concerns about response quality,a(n)_

Q38: The sum of the squared deviations from

Q40: What type of design is shown in

Q53: What is systematic random sampling and how

Q60: Internal validity is to quantitative research as

Q63: The model for generalizing from one study