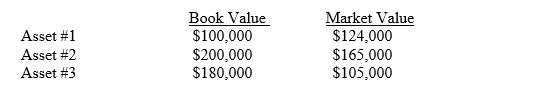

Julia Corp has three asset whose market values differ from their book values.

The market value of the first asset is expected to remain above the book value of Asset #1

The market value of the first asset is expected to remain above the book value of Asset #1

for the life of the asset.

The market value of the second asset moves above and below the book value from year to

year.

The market value of the last asset is viewed as a permanent decline below the book value

of the asset.

Required:

A.Make the entry(ies) necessary to record the differences between the market and book values of the assets.

B.If the book values are adjusted to market values what impact will this have on the depreciation of the adjusted asset?

Definitions:

Atomic Orbital

A mathematical function that describes the wave-like behavior of an electron in an atom, indicating the probability of the electron’s presence at a particular location.

Photon

A particle of electromagnetic radiation; one quantum of radiant energy.

Light Energy

The form of energy visible to the human eye that is emitted by the sun and other sources, crucial for photosynthesis in plants.

Electromagnetic Spectrum

The entire span of electromagnetic radiation, extending from gamma rays to radio waves.

Q4: Using horizontal analysis,the figure that would appear

Q22: You have just purchased a new Corvette

Q35: John Stamos will have $1,000,000 in his

Q49: Which of the following is not one

Q51: All other factors being equal a $1,000,000,10

Q62: One example of a contra-asset is:<br>A)Sales Discount<br>B)Sales

Q75: Golden Eagle Golf Corp sold equipment with

Q77: Using horizontal analysis,the figure that would appear

Q81: The gross margin percentage for 2010 was:<br>A)33.0%<br>B)40.1%<br>C)42.2%<br>D)45.6%

Q108: "If a firm issues bonds at more