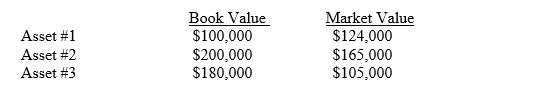

Julia Corp has three asset whose market values differ from their book values.

The market value of the first asset is expected to remain above the book value of Asset #1

The market value of the first asset is expected to remain above the book value of Asset #1

for the life of the asset.

The market value of the second asset moves above and below the book value from year to

year.

The market value of the last asset is viewed as a permanent decline below the book value

of the asset.

Required:

A.Make the entry(ies) necessary to record the differences between the market and book values of the assets.

B.If the book values are adjusted to market values what impact will this have on the depreciation of the adjusted asset?

Definitions:

Replacement Cost

The current cost of replacing an asset with a similar one at its current market price.

Reorganization

A process aimed at restructuring a company's financial or operational aspects for efficiency or to facilitate a smoother operation.

Prepaid Expense

An expense paid in advance and recorded as an asset until it is used or consumed.

Q9: One example of a contra-revenue account is:<br>A)allowance

Q27: Barton Inc had assets of $15,350,000 and

Q27: Assuming an 8% interest rate,the dollar amount

Q29: A capital investment generates a satisfactory rate

Q36: A stockholder who received a 10% common

Q39: Plant assets are reported on the balance

Q45: Callisto began 2008 with 100,000 shares of

Q60: Would a firm prefer straight-line or accelerated

Q79: If a vertical analysis were performed relative

Q101: When a company retires its outstanding bonds