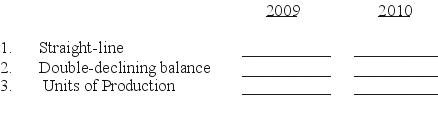

Calculate the depreciation for a $246,000 asset with a $10,000 salvage value that can produce 400,000 units over its 10-year life using the following methods.Assume the asset was purchased Oct 1 ,2009.During 2009 the asset produced 13,000 units and in 2010 it produced 28,000 units.How much depreciation expense will be recorded for 2009 and 2010.Write answers in the spaces below.YOU MUST SHOW YOUR WORK TO RECEIVE ANY CREDIT!

Definitions:

Obtain Consent

The act of getting permission for a specific action from a person or entity, ensuring that the action is legally and ethically acceptable.

Tort Liability

Legal responsibility arising from wrongful acts or omissions other than breach of contract that cause harm or loss to another party.

Professional Service

Specialized work provided by individuals with expert knowledge or skills in a particular area.

Fiduciary Duty

A legal obligation of one party to act in the best interest of another when entrusted with certain responsibilities, typically in financial or property matters.

Q1: You want to have $50,000 in a

Q22: Why would a banker reject a company's

Q25: Given the below data,create the inventory cost

Q33: If stock with a $2 par value

Q34: The present value of a future cash

Q43: A machine with a cost of $196,500,and

Q52: What item would be included in "other

Q54: For the year ended December 31,2010,Running,Inc.had a

Q62: Compare stock splits and stock dividends in

Q71: The journal entry to record a sales