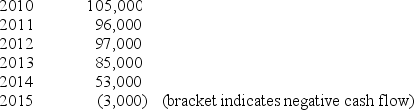

The Katrina Corp is considering the purchase of a new machine that produces hurricane proof windows in January 2010.The window machine will cost $300,000 and Katrina's management expects it to last 6 years.At the end of six years the new machine is expected to have a zero book value but could be sold for $25,000.Depreciation each year on the window machine will be $50,000 and Katrina's tax rate is 30%.The Pretax cash flows expected from the machine are as follows:

Required:

Required:

(A.)Calculate the net present of the new machine if the cost of capital is 15%.

(B.)Indicate whether or not Katrina should buy the new machine and explain the basis for your decision (do not use positive or negative NPV as an explanation):

Definitions:

Fit for Particular Purpose(s)

A legal concept that implies a sold item is suitable for the specific use intended by the buyer, which the seller is aware of.

Adequately Contained

A condition in which something is sufficiently controlled or held to prevent harm or spread.

Labeled

The action of attaching identification, instructions, or contents information to a product or item.

Express Warranty

A guarantee explicitly stated by a seller regarding the condition, functionality, or performance of a product.

Q6: Lisa Corsetti would like to have $50,000

Q7: The Piante Company has an accounts receivable

Q7: Uncollectible Accounts Expense and Allowance for Doubtful

Q9: Architect's fees during construction of a building

Q30: Big Cat Inc.has the below balances (Year

Q33: Which of the following statements about earnings

Q44: The journal entry to record a customer's

Q53: JAFCO,Inc.reported insurance expense of $137,000,prepaid insurance of

Q57: George Ryan obtained a car loan that

Q69: The total amount of interest expense over