Use the following to answer questions

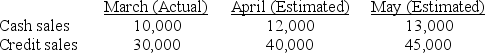

Hepburn Corporation's sales price is $30 per unit. Unit sales information is presented below:

Management estimates that 2% of credit sales are uncollectible. Of the remaining credit sales, 30 percent are collected in the month of sale and the remainder in the following month. The March 31 ending inventory is 5,500 units, and Hepburn wants to have 10% of the next month's sales in ending finished goods inventory.

Management estimates that 2% of credit sales are uncollectible. Of the remaining credit sales, 30 percent are collected in the month of sale and the remainder in the following month. The March 31 ending inventory is 5,500 units, and Hepburn wants to have 10% of the next month's sales in ending finished goods inventory.

-Hepburn pays for direct labor and overhead as incurred.It pays for 80 percent of raw material purchases during the month of purchase and the remainder during the next month.Accounts payable on March 31,was $400,000.What amount should Hepburn budget for cash payments for production costs during April?

Definitions:

Break-even Chart

A graphical representation showing the point at which total costs and total revenues are equal, indicating no net loss or gain.

Fixed Costs

Fixed costs are expenses that do not change with the level of production or sales, such as rent, salaries, and insurance.

Variable Costs

Costs that change in proportion to the level of production or business activity.

Profit

The financial gain made in a transaction or operation, calculated as the difference between revenue and expenses.

Q7: When calculating the present or future value

Q11: Klocke Corporation's sales for January,2010,were $1,350,000.Klocke projects

Q20: For the collection process,which of the following

Q20: Short-term decision making differs from normal operating

Q32: Objective knowledge, in any field of study,

Q35: John Stamos will have $1,000,000 in his

Q51: Which of the following payroll items is

Q54: A favorable sales price variance means<br>A)The cost

Q83: Prepare journal entries to record the following

Q86: Accountants use the term "credit" to refer