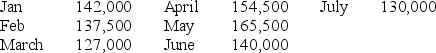

Logan Enterprises' unit production is budgeted for the first six months of its upcoming fiscal year as follows:

Each unit of product requires 20 pounds of raw material that Logan purchases for $3.50 per pound.The company began the month of March with 13,160 pounds of raw material but wants its ending inventory of raw material to be 2% of the next month's production requirements beginning with the end of March.

Each unit of product requires 20 pounds of raw material that Logan purchases for $3.50 per pound.The company began the month of March with 13,160 pounds of raw material but wants its ending inventory of raw material to be 2% of the next month's production requirements beginning with the end of March.

Logan pays for 20% of its purchases in the month of purchase,with the remainder paid the following month.Determine the amount of planned cash disbursements for purchases of raw materials for April,May and June.

Definitions:

Spreadsheet

A digital document that uses rows and columns to organize data, calculations, and information, commonly used in accounting and financial analysis.

Multiplier

A factor used in economics to quantify the effect of investment spending on the aggregate income or output of an economy.

Full Retirement Age

Age at which a person receives full retirement Social Security benefits.

IRA

An Individual Retirement Account, a saving tool that allows individuals to set aside money for retirement with tax advantages.

Q1: Y = m(X)is the formula for a(n):<br>A)Activity

Q19: Non Troppo Corporation has the following cost

Q35: The type of environment where a large

Q46: Morland Corp purchased a building that will

Q46: The account which is reported at its

Q50: Expenditures associated with items already purchased,that are

Q52: Which of the following is not a

Q61: The Customer Deposits account is reported on

Q65: Bug-Ez Corporation manufactures one product,Itch-A-Way,which,when applied to

Q78: The human, informational, material, and financial resources