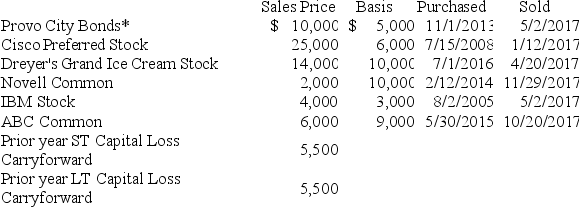

Scott Bean is a computer programmer and incurred the following transactions last year.

*Purchased when originally issued by Provo City

*Purchased when originally issued by Provo City

What is the Net Short-Term Capital Gain/Loss reported on the 2017 Schedule D? What is the Net Long-Term Capital Gain/Loss reported on the 2017 Schedule D? What amount of capital gain is subject to the preferential capital gains rate?

Definitions:

Fiberglass

A material consisting of extremely fine glass fibers, used in various applications including insulation and reinforcement.

Plaster

A soft mixture of lime with sand or cement and water for spreading on walls, ceilings, or other structures to form a smooth hard surface when dried.

Dressing

A sterile material used to cover a surgical or other wound.

Diabetic Coma

A life-threatening emergency arising from uncontrolled diabetes, characterized by extreme hyperglycemia or hypoglycemia.

Q13: Wendell is an executive with CFO Tires.At

Q26: Trudy is Jocelyn's friend.Trudy looks after Jocelyn's

Q62: When a taxpayer sells an asset,the entire

Q63: Manassas purchased a computer several years ago

Q67: How can electing to include long-term capital

Q73: Maurice is currently considering investing in a

Q83: The definition of qualifying expenses is more

Q96: A personal automobile is a capital asset.

Q96: Constance currently commutes 25 miles from

Q116: The late payment penalty is based on