Essay

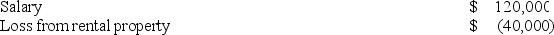

Judy,a single individual,reports the following items of income and loss:

Judy owns 100% of the rental property and actively participates in the rental of the property.Calculate Judy's AGI.

Judy owns 100% of the rental property and actively participates in the rental of the property.Calculate Judy's AGI.

Definitions:

Related Questions

Q7: A loss deduction from a casualty of

Q11: Sequoia purchased the rights to cut timber

Q26: A parcel of land is always a

Q35: Lisa and Collin are married.Lisa works as

Q57: Littman LLC placed in service on July

Q60: Redoubt LLC traded machinery used in its

Q62: Which of the following may qualify as

Q82: Claim of right states that income has

Q93: Cassy reports a gross tax liability of

Q117: If an unmarried taxpayer is able to