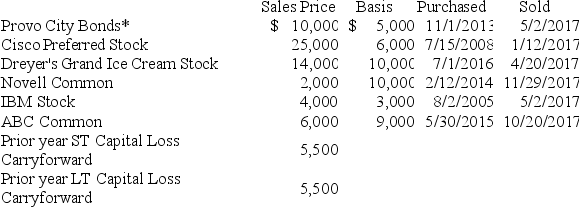

Scott Bean is a computer programmer and incurred the following transactions last year.

*Purchased when originally issued by Provo City

*Purchased when originally issued by Provo City

What is the Net Short-Term Capital Gain/Loss reported on the 2017 Schedule D? What is the Net Long-Term Capital Gain/Loss reported on the 2017 Schedule D? What amount of capital gain is subject to the preferential capital gains rate?

Definitions:

Orphan

A child who has lost both parents through death or, in some definitions, a child who has lost one parent.

Account Penetration

The process of deepening relationships with existing customers by selling more products or services.

Transactional Relationship

A business relationship focused primarily on the exchange of goods or services for payment, with little personal connection.

Distinct Component

a unique and identifiable part of a larger system or product, which serves a specific function and is often necessary for the overall operation or effectiveness.

Q9: Which one of the following is not

Q15: Which depreciation convention is the general rule

Q46: Which of the following is a true

Q56: Sandy Bottoms Corporation generated taxable income (before

Q61: Assets held for investment and personal use

Q63: Bonnie and Ernie file a joint return.Bonnie

Q70: Lucinda is contemplating a long range planning

Q76: Hank is a U.S.citizen and is doing

Q125: George purchased a life annuity for $3,200

Q149: In 2017,John (52 years old)files as a