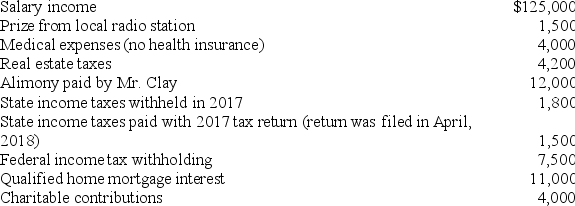

During all of 2017,Mr.and Mrs.Clay lived with their four children (all are under the age of 17).They provided over one-half of the support for each child.Mr.and Mrs.Clay file jointly for 2017.Neither is blind,and both are under age 65.They reported the following tax-related information for the year: (use the tax rate schedules in the text)

A.What is the Clays' taxes payable or (refund due)(Ignore the alternative minimum tax)?

A.What is the Clays' taxes payable or (refund due)(Ignore the alternative minimum tax)?

B.What is the Clays' tentative minimum tax and alternative minimum tax?

Definitions:

Fair Value

The estimated market price of an asset or liability, based on current market conditions and comparable transactions.

Increasing-Balance

A method of calculating depreciation that applies a constant rate to the asset's net book value each year, resulting in increased depreciation charges over time.

Units-Of-Production

A depreciation method that allocates cost based on the units produced or the machine hours used during the period.

Straight-Line

A method of allocating the cost of a tangible asset over its useful life in equal yearly amounts.

Q6: Which of the following statements regarding Roth

Q9: Which of the following is not an

Q16: Ms.Fresh bought 1,000 shares of Ibis Corporation

Q44: Lara,a single taxpayer with a 30 percent

Q61: Dean has earned $70,000 annually for the

Q67: Bruce is employed as an executive and

Q76: Jaussi purchased a computer several years ago

Q81: Which of the following is true regarding

Q110: Persephone has a regular tax liability of

Q113: Which of the following is a description