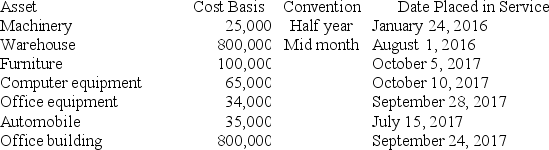

Boxer LLC has acquired various types of assets recently used 100% in its trade or business.Below is a list of assets acquired during 2016 and 2017:

Boxer did not elect §179 expense and elected out of bonus depreciation in 2016,but would like to elect §179 expense for 2017 (assume that taxable income is sufficient).Calculate Boxer's maximum depreciation expense for 2017,(ignore bonus depreciation for 2017).If necessary,use the 2016 luxury automobile limitation amount for 2017.(Use MACRS Table 1 and Use MACRS Table 5 in the text)Exhibit 10-8 in the text (Round final answer to the nearest whole number)

Boxer did not elect §179 expense and elected out of bonus depreciation in 2016,but would like to elect §179 expense for 2017 (assume that taxable income is sufficient).Calculate Boxer's maximum depreciation expense for 2017,(ignore bonus depreciation for 2017).If necessary,use the 2016 luxury automobile limitation amount for 2017.(Use MACRS Table 1 and Use MACRS Table 5 in the text)Exhibit 10-8 in the text (Round final answer to the nearest whole number)

Definitions:

Industrial Regulation

The imposition of rules by the government on firms and industries to promote competition, control monopoly power, protect consumers, and regulate prices and service quality.

Production Costs

Expenses incurred in the process of manufacturing or producing goods, including materials, labor, and overhead costs.

Industrial Regulation

Involves government rules and policies aimed at controlling the practices, standards, and market entry of firms in specific industries to prevent unfair practices and promote competition.

X-Inefficiency

An economic concept that captures inefficiencies in a firm's operations due to factors such as a lack of competitive pressure.

Q6: Simmons LLC purchased an office building and

Q12: When employees contribute to a traditional 401(k)plan,they

Q15: The date on which stock options are

Q22: Assume that Yuri acquires a competitor's assets

Q36: A nurse is demonstrating the professional role

Q66: Employee contributions to traditional 401(k)accounts are deductible

Q74: Deborah (single,age 29)earned $25,000 in 2017.Deborah was

Q78: Smith operates a roof repair business.This year

Q86: The 12-month rule allows taxpayers to deduct

Q118: How could an individual obtain a business