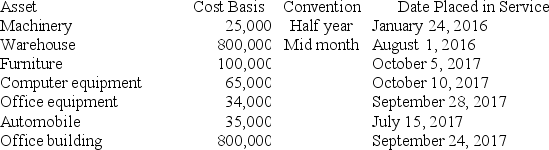

Boxer LLC has acquired various types of assets recently used 100% in its trade or business.Below is a list of assets acquired during 2016 and 2017:

Boxer did not elect §179 expense and elected out of bonus depreciation in 2016,but would like to elect §179 expense for 2017 (assume that taxable income is sufficient).Calculate Boxer's maximum depreciation expense for 2017,(ignore bonus depreciation for 2017).If necessary,use the 2016 luxury automobile limitation amount for 2017.(Use MACRS Table 1 and Use MACRS Table 5 in the text)Exhibit 10-8 in the text (Round final answer to the nearest whole number)

Boxer did not elect §179 expense and elected out of bonus depreciation in 2016,but would like to elect §179 expense for 2017 (assume that taxable income is sufficient).Calculate Boxer's maximum depreciation expense for 2017,(ignore bonus depreciation for 2017).If necessary,use the 2016 luxury automobile limitation amount for 2017.(Use MACRS Table 1 and Use MACRS Table 5 in the text)Exhibit 10-8 in the text (Round final answer to the nearest whole number)

Definitions:

Break-Even Analysis

A financial calculation that determines the point at which total revenues equal total costs, indicating no profit or loss.

Variable Expenses

Costs that change in proportion to the level of activity or volume of output produced.

Unit Fixed Expenses

These are expenses that do not change with the level of production or sales within a certain range and are calculated per unit of product.

Absorption Costing

An accounting method that includes all manufacturing costs - direct materials, direct labor, and both variable and fixed overhead - as part of the cost of a finished unit of product.

Q12: Kristen rented out her home for 10

Q32: Which of the following is not true

Q37: Which of the following is a true

Q51: Serena is single.She purchased her principal residence

Q70: Which of the following forms is filled

Q76: Which of the following expenditures is most

Q90: §1231 assets include all assets used in

Q97: Which of the following does not qualify

Q98: If certain conditions are met,an apartment manager

Q99: Santa Fe purchased the rights to extract