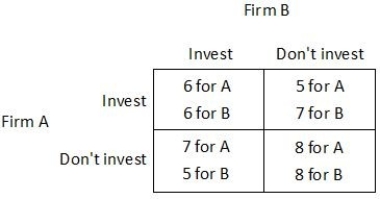

Suppose Firm A and Firm B are considering whether to invest in a new production technology. For each firm, the payoff to investing (given in thousands of dollars per day) depends upon whether the other firm invests, as shown in the payoff matrix below.  Which of the following statements is correct?

Which of the following statements is correct?

Definitions:

Amortizable Capital Assets

Long-term assets whose cost is gradually expensed over their useful life, such as buildings and equipment.

Temporary Differences

Differences between the accounting value and tax value of assets and liabilities, resulting in deferred tax assets or liabilities.

Deferred Income Taxes

Taxes that are assessed or paid on income that is recognized in one period for financial reporting purposes but in a different period for tax purposes.

Fair Value Increments

Increases in the value of an asset or security that result from a reassessment of its fair value, often reflected in financial statements to show current market conditions.

Q21: Which of the following is an example

Q32: Two firms, Acme and FirmCo, have access

Q42: Two firms, Industrio and Capitalista, have access

Q48: Pascal is risk-averse while Marion is risk-neutral.

Q57: Assume that all firms in this industry

Q69: Suppose Jordan and Lee are trying to

Q80: Assume that the production technology required to

Q130: Suppose Sarah owns a small company

Q148: When Brady is driving he throws his

Q157: Suppose the production of cotton causes substantial