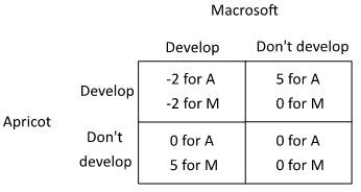

Suppose two companies, Macrosoft and Apricot, are considering whether to develop a new product, a touch-screen t-shirt. The payoffs to each of developing a touch-screen t-shirt depend upon the actions of the other, as shown in the payoff matrix below (the payoffs are given in millions of dollars) .  Suppose Apricot makes its decision first, and then Macrosoft makes its decision after seeing Apricot's choice. What will happen if, before Apricot chooses, Macrosoft announces that it is going to develop a touch-screen t-shirt no matter what Apricot does?

Suppose Apricot makes its decision first, and then Macrosoft makes its decision after seeing Apricot's choice. What will happen if, before Apricot chooses, Macrosoft announces that it is going to develop a touch-screen t-shirt no matter what Apricot does?

Definitions:

Discount Rate

The interest rate used to discount future cash flows of a project or investment to determine its present value.

Defensive Merger

A strategy where a company merges with or acquires another company to protect itself against potential competitors or hostile takeovers.

Hostile Takeover

An acquisition attempt by a company or individual against the target company's wishes.

Cash Bidding Price

The price offered in cash during an auction or bidding process for an asset or item.

Q22: A cost of an activity that falls

Q46: Assume that all firms in this industry

Q62: The payoff matrix below shows the payoffs

Q77: Grace and Will are moving to LA

Q90: The figure below depicts the short-run market

Q99: Which of the following is NOT an

Q104: If a Proposer and a Responder are

Q118: Generally, _ motivates firms to enter an

Q127: Sam owns a candy factory and

Q139: The essential reason some species of whales