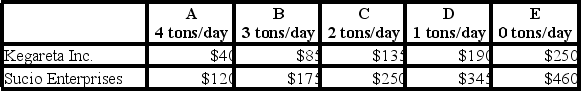

Two firms, Kegareta Inc. and Sucio Enterprises, have access to five production processes, each one of which has a different cost and gives off a different amount of pollution. The daily costs of the processes and the corresponding number of tons of smoke emitted are shown in the accompanying table.

Suppose the government imposes a tax of $56 per day on each ton of smoke emitted. Assuming the revenue the government collects from the tax is used to offset other taxes, what's the total cost to society of this policy?

Definitions:

Personal Use

The use of a property or item by the owner or their family for non-business and non-rental purposes, affecting the tax implications of expenses related to the property or item.

Schedule E

Schedule E is a form used by taxpayers to report income and losses from rental property, royalties, partnerships, S corporations, estates, and trusts on their tax returns.

Schedule A

This refers to a form used by U.S. taxpayers to itemize deductions on their federal income tax return.

Investment Expense

Costs incurred related to the purchase, management, and sale of investments, potentially deductible from taxable income for certain investors.

Q11: When the government transfers resources to the

Q19: An economy has two workers, Jen and

Q22: The fact that many primary and secondary

Q31: The following data show the relationship

Q34: Player 1 and Player 2 are playing

Q35: Alex, who is risk-neutral, is looking for

Q37: Frank is considering moving to Denver. There

Q60: When players cannot achieve their goals because

Q136: This graph shows the marginal cost and

Q140: Emotions like guilt and sympathy:<br>A)are irrelevant to