Scenario

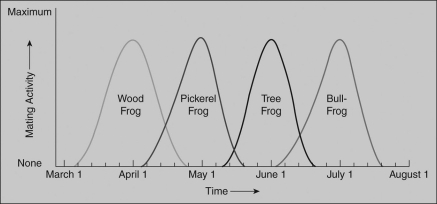

As part of a semester-long biology field research course, you are studying reproductive barriers among four different frog species. Your goal is to determine what type of reproductive barrier likely causes the gene pools of the four different frog species to be isolated. These four species share common geographic habitats and are both anatomically and gametically compatible. Your research professor gives you the following figure to consider. After studying the figure, answer the questions that follow.

-Based on the independent and dependent variables represented in the figure and the information you have about common geographic habitats as well as anatomical and gametic compatibility of the four frog species, you initially conclude that reproductive barriers may be due to ________.

Definitions:

Marginal Tax Rate

The tax rate that applies to each additional dollar of income, indicating how much of the next dollar earned will be taken in taxes.

Average Tax Rate

Average Tax Rate is the proportion of the total income paid as taxes, calculated by dividing the total taxes by the total taxable income.

Total Taxes

The combined amount of all the taxes imposed by a government on an individual or business, including income tax, property tax, sales tax, etc.

Average Tax Rate

The proportion of total income that is paid in taxes, calculated by dividing the total tax paid by the total income.

Q8: Species found in only one place on

Q8: Which of the following is TRUE of

Q16: The CORRECT sequence of stages of mitosis

Q22: At high temperatures this animal loses water

Q32: The prokaryotic group that tends to inhabit

Q38: Through what structure(s)do plants obtain most of

Q38: Many human traits,such as our performance on

Q42: STR analysis can also be used for

Q48: While on an archaeology expedition,you unearth a

Q52: Which of the following statements about pollination