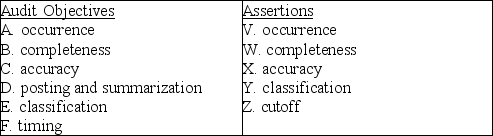

Below are five audit procedures, all of which are tests of transactions associated with the audit of the sales and collection cycle. Also, below are the six general transaction-related audit objectives and the five management assertions. For each audit procedure, indicate (1) its audit objective, and (2) the management assertion being tested.

1. Vouch recorded sales from the sales journal to the file of bills of lading.

1. Vouch recorded sales from the sales journal to the file of bills of lading.

(1) ________

(2) ________

2. Compare dates on the bill of lading, sales invoices, and sales journal to test for delays in recording sales transactions.

(1) ________

(2) ________

3. Account for the sequence of prenumbered bills of lading and sales invoices.

(1) ________

(2) ________

4. Trace from a sample of prelistings of cash receipts to the cash receipts journal, testing for names, amounts, and dates.

(1) ________

(2) ________

5. Examine customer order forms for credit approval by the credit manager.

(1) ________

(2) ________

Definitions:

Operating Segments

Individual, identifiable components of an enterprise that engage in business activities, earn revenues, and incur expenses.

Reportable

Pertaining to information or data that must be disclosed or presented in official reports.

LIFO Cost-Flow

A method in inventory valuation where the most recently produced or acquired items are considered sold first, leading to older inventory costs being reported in the financial statements.

Cost of Goods Sold

The direct costs attributable to the production of the goods sold by a company, including materials and labor costs.

Q15: Adverse interest is the threat that a

Q16: Under the Securities Act of 1933,<br>A) any

Q33: "Physical examination" is the inspection or count

Q37: A CPA firm normally uses one or

Q42: An auditor who issues a qualified opinion

Q90: Assume you are the partner in charge

Q97: _, generally, provide the most reliable evidence.<br>A)

Q121: The most important general ledger account included

Q137: Which of the following management assertions is

Q147: In order to obtain an understanding of