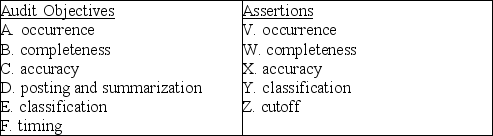

Below are five audit procedures, all of which are tests of transactions associated with the audit of the acquisition and payment cycle. Also, below are the six general transaction-related audit objectives and the five management assertions. For each audit procedure, indicate (1) its audit objective, and (2) the management assertion being tested.

1. Foot the purchases journal and trace the totals to the related general ledger accounts.

1. Foot the purchases journal and trace the totals to the related general ledger accounts.

(1) ________

(2) ________

2. Recompute the cash discounts taken by the client.

(1) ________

(2) ________

3. Compare dates on cancelled checks with the bank cancellation date.

(1) ________

(2) ________

4. Trace from a sample of cancelled checks to the cash disbursements journal.

(1) ________

(2) ________

5. Examine supporting documentation for a sample of transactions for authorized payee and amount and to determine services or goods were received.

(1) ________

(2) ________

Definitions:

Direction

A course along which something moves, points, or faces, often implying a trend or tendency in data, processes, or movements.

Scatterplot

A type of graph used in statistics to visually display and compare two variables for a set of data, showing how much one variable is affected by another.

Two-Way Table

A table that displays data about two categorical variables; used to explore the relationship between the two variables.

Scatterplot Strength

Indicative of the degree of correlation between two variables represented in a scatterplot, showing how closely the data points fit a trend line.

Q4: List and briefly describe cases and examples

Q12: Under the cycle approach to segmenting an

Q19: Zero risk is certainty, and a 100%

Q22: Many risks are common to all clients

Q37: A CPA sole practitioner purchased stock in

Q39: If an auditor is unsuccessful in using

Q45: A suspension of judgment is the recognition

Q58: Due to qualitative factors, certain types of

Q83: It becomes obvious that a member of

Q165: The SEC requires the auditors of public