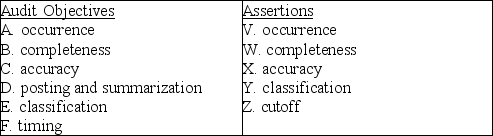

Below are five audit procedures, all of which are tests of transactions associated with the audit of the sales and collection cycle. Also, below are the six general transaction-related audit objectives and the five management assertions. For each audit procedure, indicate (1) its audit objective, and (2) the management assertion being tested.

1. Vouch recorded sales from the sales journal to the file of bills of lading.

1. Vouch recorded sales from the sales journal to the file of bills of lading.

(1) ________

(2) ________

2. Compare dates on the bill of lading, sales invoices, and sales journal to test for delays in recording sales transactions.

(1) ________

(2) ________

3. Account for the sequence of prenumbered bills of lading and sales invoices.

(1) ________

(2) ________

4. Trace from a sample of prelistings of cash receipts to the cash receipts journal, testing for names, amounts, and dates.

(1) ________

(2) ________

5. Examine customer order forms for credit approval by the credit manager.

(1) ________

(2) ________

Definitions:

Internal Process

Activities and operations carried out within an organization to ensure the effective creation of goods or delivery of services.

Innovation And Learning

The process of creating new ideas, products, or methods and the acquisition of knowledge to improve efficiency or effectiveness.

Residual Income

A measure of the income that exceeds the minimum required return on a company's investments or operations.

Divisional Income

The earnings generated by a specific division or segment of a larger company, used for evaluating the division's financial performance.

Q20: A questioning mindset<br>A) means the auditor must

Q31: After assessing internal controls are being effective

Q60: The term "tolerable misstatement," used by the

Q94: Due to a shortage of personnel, the

Q95: A _ risk represents an identified and

Q97: Which of the following circumstances impairs an

Q114: The five steps in applying materiality are

Q158: Which of the following statements is the

Q164: Which is usually included in an engagement

Q164: When the client fails to include information