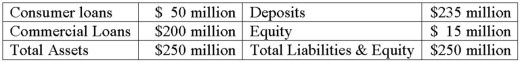

The average duration of the loans is 10 years. The average duration of the deposits is 3 years.  What is the number of T-bond futures contracts necessary to hedge the balance sheet if the duration of the deliverable bonds is 9 years and the current price of the futures contract is $96 per $100 face value and if basis risk shows that for every 1 percent shock to interest rates, i.e., ΔR/(1 + R) = 0.01, the implied rate on the deliverable bonds in the futures market increases by 1.1 percent, i.e., ΔRf/(1 + Rf) = 0.011?

What is the number of T-bond futures contracts necessary to hedge the balance sheet if the duration of the deliverable bonds is 9 years and the current price of the futures contract is $96 per $100 face value and if basis risk shows that for every 1 percent shock to interest rates, i.e., ΔR/(1 + R) = 0.01, the implied rate on the deliverable bonds in the futures market increases by 1.1 percent, i.e., ΔRf/(1 + Rf) = 0.011?

Definitions:

Cystic Fibrosis

A genetic disease affecting the lungs and digestive system, characterized by thick, sticky mucus leading to infections and digestion problems.

Mucus Thickens

A condition where the mucus becomes more viscous, often leading to congestion and difficulty in breathing or clearing passages.

Meconium Ileus

A blockage of the small intestines caused by thick, sticky meconium in newborn babies, often associated with cystic fibrosis.

Cystic Fibrosis

A genetic disorder that affects the lungs, pancreas, and other organs, leading to thick sticky mucus production, which causes respiratory and digestive problems.

Q6: An FI manager purchases a zero-coupon bond

Q8: Bank Canada has fixed-rate assets of $50

Q15: Risk-based capital supports risk-based deposit insurance premiums

Q17: In a forward contract agreement, the quantity

Q56: CMHC will securitize conventional mortgages issued by

Q59: The three Canadian government agencies that sponsor

Q76: The buyer of a loan participation benefits

Q101: The covariance of the change in spot

Q105: The use of futures contracts by banks

Q146: What is the reason for decrease in