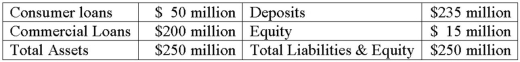

The average duration of the loans is 10 years. The average duration of the deposits is 3 years.  What is the number of T-bond futures contracts necessary to hedge the balance sheet if the duration of the deliverable bonds is 9 years and the current price of the futures contract is $96 per $100 face value and if basis risk shows that for every 1 percent shock to interest rates, i.e., ΔR/(1 + R) = 0.01, the implied rate on the deliverable bonds in the futures market increases by 1.1 percent, i.e., ΔRf/(1 + Rf) = 0.011?

What is the number of T-bond futures contracts necessary to hedge the balance sheet if the duration of the deliverable bonds is 9 years and the current price of the futures contract is $96 per $100 face value and if basis risk shows that for every 1 percent shock to interest rates, i.e., ΔR/(1 + R) = 0.01, the implied rate on the deliverable bonds in the futures market increases by 1.1 percent, i.e., ΔRf/(1 + Rf) = 0.011?

Definitions:

Economic Growth

An increase in the production of goods and services in an economy over a period of time, often measured by the rise in the country's gross domestic product (GDP).

Industrially Advanced Countries

High-income countries such as the United States, Canada, Japan, and the nations of western Europe that have highly developed market economies based on large stocks of technologically advanced capital goods and skilled labor forces.

IACs

An abbreviation that could stand for various entities or concepts; without additional context, providing a specific definition is not feasible.

Real Per Capita Output

A measure of the economic output of a country per person, adjusted for inflation, indicating the average living standard or economic well-being of its citizens.

Q2: The sellers of domestic loans and HLT

Q8: Property & casualty insurance companies typically have

Q17: When are the standby letters of credit

Q19: The buyer of a loan participation bears

Q24: As of 2011, credit cards used in

Q30: Buying a call option on a bond

Q44: Operational risk has increased to a point

Q85: Routine hedging<br>A)is a hedging strategy that occurs

Q92: Off-balance sheet activities can have both positive

Q189: Derivative contracts allow an FI to manage