The average duration of the loans is 10 years. The average duration of the deposits is 3 years.  What is the number of T-bond futures contracts necessary to hedge the balance sheet if the duration of the deliverable bonds is 9 years and the current price of the futures contract is $96 per $100 face value and if basis risk shows that for every 1 percent shock to interest rates, i.e., ΔR/(1 + R) = 0.01, the implied rate on the deliverable bonds in the futures market increases by 1.1 percent, i.e., ΔRf/(1 + Rf) = 0.011?

What is the number of T-bond futures contracts necessary to hedge the balance sheet if the duration of the deliverable bonds is 9 years and the current price of the futures contract is $96 per $100 face value and if basis risk shows that for every 1 percent shock to interest rates, i.e., ΔR/(1 + R) = 0.01, the implied rate on the deliverable bonds in the futures market increases by 1.1 percent, i.e., ΔRf/(1 + Rf) = 0.011?

Definitions:

Selling Prices

The amounts of money charged to customers in exchange for goods or services.

Plantwide Predetermined Manufacturing Overhead Rate

A single overhead rate calculated by dividing total estimated manufacturing overhead costs by an estimated allocation base, used across an entire plant or facility.

Departmental Predetermined Overhead Rates

A method of calculating overhead rates for specific departments within a company, rather than using a single overhead rate for the entire organization.

Machine-Hours

A measure of production output or operational time, calculated by the number of hours a machine is run during a specific period.

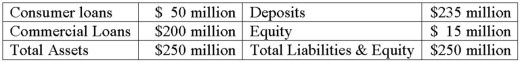

Q26: The following market value balance sheet of

Q30: Although secure communications can be carried out

Q34: The risk-based capital ratio fails to take

Q43: CBOT catastrophe call spread options have variable

Q65: Concern about bank solvency has been used

Q71: The largest segment of the global swap

Q79: Assume a binomial pricing model where there

Q83: Why are the regular NHA MBS pass-throughs

Q102: Catastrophe futures are designed to hedge extreme

Q110: The tendency of the variance of a