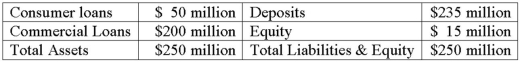

The average duration of the loans is 10 years. The average duration of the deposits is 3 years.  What is the number of T-Bill futures contracts necessary to hedge the balance sheet if the duration of the deliverable T-bills is 0.25 years and the current price of the futures contract is $98 per $100 face value?

What is the number of T-Bill futures contracts necessary to hedge the balance sheet if the duration of the deliverable T-bills is 0.25 years and the current price of the futures contract is $98 per $100 face value?

Definitions:

Q8: Basel III capital ratios will become fully

Q28: When a bank enters into a fixed-floating

Q28: Standby letters of credit are classified as<br>A)on-balance-sheet

Q56: Writing an interest rate call option may

Q65: Which of the following is not included

Q94: Off-balance sheet positions are risky because they

Q106: Providing for the transmission of invoices, purchase

Q123: What does R<sup>2</sup> = 0 indicate?<br>A)Changes in

Q144: Hedging foreign exchange risk in the futures

Q231: Pension funds<br>A)Net buyer (typically)<br>B)Net seller (typically)