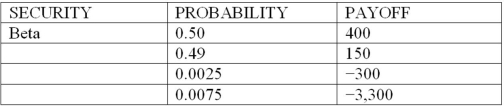

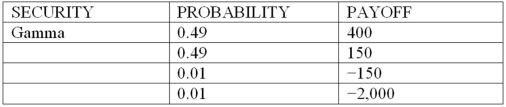

Consider the following discrete probability distributions of payoffs for 3 securities that are held in a DI's trading portfolio (payoff amounts shown are in $millions) :

What is the one-day, 99% confidence level, value at risk (VAR) of securities Alpha and Beta, respectively (in millions) ?

What is the one-day, 99% confidence level, value at risk (VAR) of securities Alpha and Beta, respectively (in millions) ?

Definitions:

Q22: The transmission of payments and payment messages

Q27: A $200 million loan commitment has an

Q34: Which model involves estimating the systematic loan

Q38: Savings accounts are less liquid than demand

Q39: Basel III guidelines for determining credit risk-adjusted

Q42: City bank has six-year zero coupon bonds

Q43: Which of the following statements best describe

Q45: The smaller the leverage adjusted duration gap,

Q71: When computing the liquidity coverage ratio, high-quality

Q80: The following is an example of a