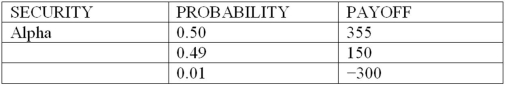

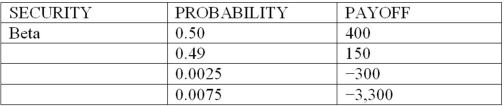

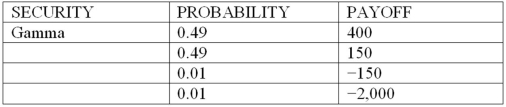

Consider the following discrete probability distributions of payoffs for 3 securities that are held in a DI's trading portfolio (payoff amounts shown are in $millions) :

Based on your answers to the previous three questions, which of the following is true?

Based on your answers to the previous three questions, which of the following is true?

Definitions:

Anticipated Synergies

The expected benefits, efficiencies, or savings generated through the combination or collaboration of different entities, projects, or processes.

Timeframe

A specified period during which certain events or activities are to take place or be completed.

Success of the Merger

The positive outcome of combining two or more companies, typically measured by financial performance, market share, and synergies achieved.

Loblaws

A Canadian supermarket chain, offering grocery products, pharmaceutics, banking, and clothing, among other things.

Q2: What are the two major liquidity risk

Q19: The duration of a portfolio of assets

Q26: Which of the following securities is most

Q32: As interest rates rise, the duration of

Q37: As a result of loan write-offs, Bank

Q61: Which of the following ratios do FIs

Q68: Which of the following is an example

Q69: The greater is convexity, the more insurance

Q85: Which of the following implies reduced unit

Q94: Off-balance sheet positions are risky because they