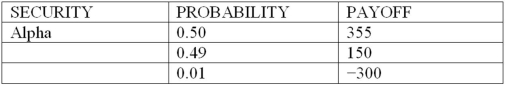

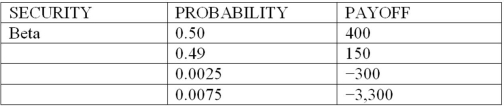

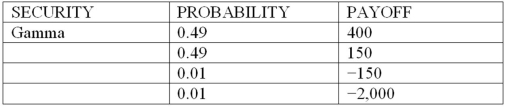

Consider the following discrete probability distributions of payoffs for 3 securities that are held in a DI's trading portfolio (payoff amounts shown are in $millions) :

What is the expected payoff, the 99% value at risk (VAR) and the expected shortfall (ES) of security Gamma (in millions) ?

What is the expected payoff, the 99% value at risk (VAR) and the expected shortfall (ES) of security Gamma (in millions) ?

Definitions:

Discount Factor

A multiplier for future cash flows to convert them into present value, reflecting the time value of money.

Contribution Margin

The amount remaining from sales revenue after variable costs are deducted, indicating how much revenue is contributing to fixed costs and profit.

Incremental Annual Net Cash Inflows

The additional cash that flows into a business on an annual basis as a result of a specific action or investment.

Investment Project

A project or activity requiring capital expenditure with the expectation of achieving future profits or benefits.

Q17: A new computer system is expected to

Q18: Immunizing net worth from interest rate risk

Q21: The simple model of migration analysis tracks

Q24: Rediscounted bankers' acceptances are classified as<br>A)on-balance-sheet assets.<br>B)off-balance-sheet

Q34: In calculating the value at risk (VAR)

Q48: In calculating the net capital for a

Q52: Which of the following is true of

Q59: Using a fixed-rate bond to immunize a

Q60: The use of expected shortfall (ES) is

Q97: The Bank of Canada has recently proposed