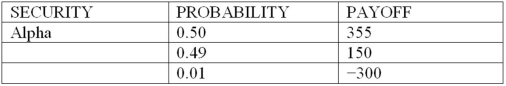

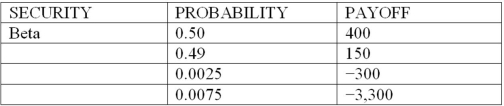

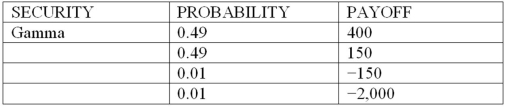

Consider the following discrete probability distributions of payoffs for 3 securities that are held in a DI's trading portfolio (payoff amounts shown are in $millions) :

What are the expected returns for securities Alpha and Beta, respectively (in millions) ?

What are the expected returns for securities Alpha and Beta, respectively (in millions) ?

Definitions:

Selling Costs

All costs that are incurred to secure customer orders and get the finished product or service into the hands of the customer.

Indirect Costs

Costs that are not directly traceable to a single product or operation, such as overhead.

Opportunity Costs

The potential benefit missed out on when choosing one alternative over another.

Conversion Cost

Conversion cost is the sum of direct labor and manufacturing overhead costs incurred to convert raw materials into finished goods.

Q14: What is the impact on economic capital

Q16: The VaR of a portfolio of assets

Q28: In models that are based on loan

Q37: Any model that seeks to estimate an

Q44: The concentration limit method of managing credit

Q45: Deposit insurance contracts can be structured to

Q48: Which of the following is a problem

Q66: Calculation of the "add-on" to the risk-based

Q67: What is the most important factor determining

Q71: Sovereign risk involves restrictions placed on borrowers