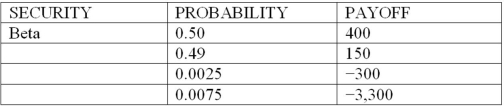

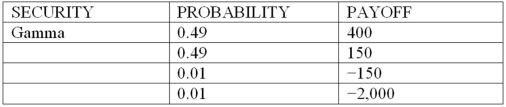

Consider the following discrete probability distributions of payoffs for 3 securities that are held in a DI's trading portfolio (payoff amounts shown are in $millions) :

What is the one-day, 99% confidence level, value at risk (VAR) of securities Alpha and Beta, respectively (in millions) ?

What is the one-day, 99% confidence level, value at risk (VAR) of securities Alpha and Beta, respectively (in millions) ?

Definitions:

Performance Standard

The expected level of performance that serves as a benchmark to evaluate an employee's job performance.

Incentive Payments

Financial rewards given to employees to encourage or reward them for achieving particular goals or performing at a superior level.

Entitlement

A right granted by law or contract, especially to financial benefits from the government.

Bonus

An incentive payment that is supplemental to the base wage.

Q4: Commercial letters of credit are used only

Q6: The extremely high growth of OBS activities

Q19: The duration of a portfolio of assets

Q24: As of 2011, credit cards used in

Q26: The operational risk faced by an FI

Q26: Recently banks have changed the liability structure

Q33: The Economist Intelligence Unit is a rating

Q47: If a stock portfolio replicates the returns

Q62: A negative net exposure position in FX

Q74: Deposit insurance is the only deterrent to