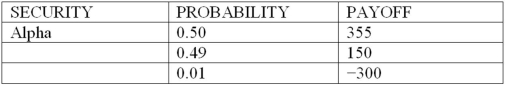

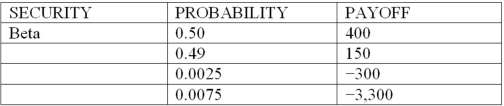

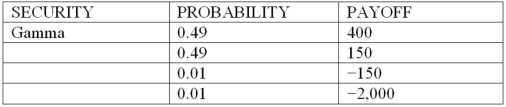

Consider the following discrete probability distributions of payoffs for 3 securities that are held in a DI's trading portfolio (payoff amounts shown are in $millions) :

What is the expected shortfall (ES) of securities Alpha and Beta at the 99 percent confidence level, respectively (in millions) ?

What is the expected shortfall (ES) of securities Alpha and Beta at the 99 percent confidence level, respectively (in millions) ?

Definitions:

Patented Item

An item or invention that is legally protected by a patent, granting its inventor exclusive rights to use, make, and sell it for a certain period.

Plant Assets

Long-term tangible assets used in the production of goods or services, typically including buildings, machinery, and equipment.

Current Assets

Assets that are expected to be converted into cash, sold, or consumed within one year or the normal operating cycle, whichever is longer.

Intangible

Assets that lack physical substance but are identifiable and provide economic benefits, such as patents and trademarks.

Q2: According to economic theory involving economies of

Q11: Which of the following observations concerning the

Q15: A $1,000 six-year Eurobond has an 8

Q23: For small change in interest rates, market

Q27: Long-term loans are more likely to be

Q38: Which of the following is true of

Q49: Loan loss ratio models are based on

Q52: Which of the following loan applicant characteristics

Q57: A contagious run, or bank panic, differs

Q73: To measure market risk at the 1