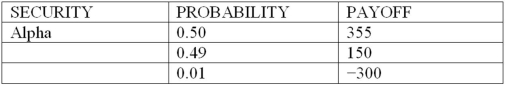

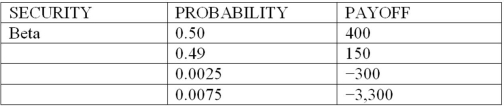

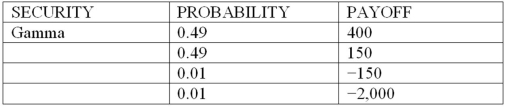

Consider the following discrete probability distributions of payoffs for 3 securities that are held in a DI's trading portfolio (payoff amounts shown are in $millions) :

What is the expected payoff, the 99% value at risk (VAR) and the expected shortfall (ES) of security Gamma (in millions) ?

What is the expected payoff, the 99% value at risk (VAR) and the expected shortfall (ES) of security Gamma (in millions) ?

Definitions:

Lateral Thinking

A problem-solving approach that involves looking at challenges from new and unconventional angles.

Creatively

In a manner that involves the use of imagination or original ideas to create something or solve problems.

Flexible Thinking

The ability to adapt thoughts and behaviors in response to changing circumstances or new information.

Brainstorming

A group discussion technique aimed at generating a wide range of ideas or solutions to a problem, without immediate criticism or evaluation.

Q16: The cost of insolvency of an FI

Q26: Which of the following securities is most

Q27: Daylight overdrafts occur when<br>A)FIs in different time

Q30: In most countries, assets used to satisfy

Q49: Profits in foreign exchange trading have grown

Q55: In Canada, commercial banks are the only

Q65: What is a fire-sale price?<br>A)Market value of

Q70: Making a lending decision to a party

Q70: Large-scale investment projects that lead to excess

Q79: The following is an example of a