Multiple Choice

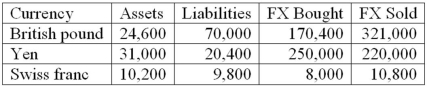

The following are the net currency positions of a Canadian FI (stated in Canadian dollars) .  How would you characterize the FI's risk exposure to fluctuations in the yen/dollar exchange rate?

How would you characterize the FI's risk exposure to fluctuations in the yen/dollar exchange rate?

Definitions:

Related Questions

Q4: If an FIs trading portfolio of stock

Q8: Which of the following is true of

Q19: The following are the assets and liabilities

Q21: Consider a six-year maturity, $100,000 face value

Q25: It is impossible for money market mutual

Q37: Both buyers and sellers of LDC debt

Q42: Investing in a zero-coupon asset with a

Q44: The duration of a soon to be

Q54: The nominal interest rate is equal to

Q60: The increased use of technology may have