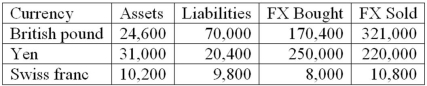

The following are the net currency positions of a Canadian FI (stated in Canadian dollars) .  How would you characterize the FI's risk exposure to fluctuations in the Swiss franc/dollar exchange rate?

How would you characterize the FI's risk exposure to fluctuations in the Swiss franc/dollar exchange rate?

Definitions:

Sampling Bias

A bias in which certain members of a population are disproportionally represented in a sample, leading to inaccurate results.

Correlation Coefficient

A statistical measure that calculates the strength and direction of a linear relationship between two quantitative variables.

Statistical Measure

A quantifiable value used to summarize or describe a set of data.

Meta-Analysis

A statistical technique that combines the results of multiple studies to derive a more comprehensive understanding of a particular research question.

Q12: The leverage adjusted duration of a typical

Q24: What is the average implicit interest rate

Q25: One way to completely protect the lender

Q26: The aggregate commitment funding risk can increase

Q26: Recently banks have changed the liability structure

Q41: International loan contracts that contain cross-default provisions

Q48: For given changes in interest rates, the

Q57: Funds transferred on the LVTS are settled

Q89: Using a modified discriminant function similar to

Q113: Which of the following statements about leverage