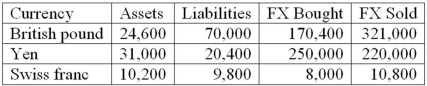

The following are the net currency positions of a Canadian FI (stated in Canadian dollars) .  How would you characterize the FI's risk exposure to fluctuations in the British pound to dollar exchange rate?

How would you characterize the FI's risk exposure to fluctuations in the British pound to dollar exchange rate?

Definitions:

Public Accounting Firms

Professional services organizations that provide accounting, audit, tax, and consulting services to businesses and individuals.

Real Risk-free Rate

The rate of return on an investment with no risk of financial loss, adjusted for inflation.

Federal Reserve

The central banking system of the United States, responsible for implementing monetary policy, regulating banks, and ensuring financial stability.

Ownership Dilution

A reduction in an individual shareholder's ownership percentage due to the issuance of additional shares by the company.

Q5: During the late 2000's financial crisis, global

Q6: In the BIS standardized framework model, the

Q6: The FI is acting as a speculator

Q32: Prior to World War II, most international

Q57: A contagious run, or bank panic, differs

Q66: On December 31, 2001 Historic Bank had

Q79: Sumitomo Bank's risk manager has estimated that

Q85: Which of the following implies reduced unit

Q88: The effect to an FI of default

Q97: The balance sheet of XYZ Bank appears