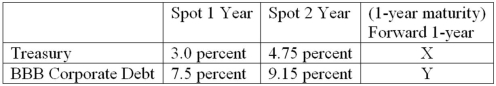

The following is information on current spot and forward term structures (assume the corporate debt pays interest annually) :  Using the term structure of default probabilities, the implied default probability for BBB corporate debt during the second year is

Using the term structure of default probabilities, the implied default probability for BBB corporate debt during the second year is

Definitions:

Hinge

A type of joint that allows for motion in one plane, much like the opening and closing of a door, commonly found in the elbows and knees.

Synovial Joints

A type of joint that is surrounded by a flexible sac filled with lubricating synovial fluid, allowing for smooth movement between the bones.

Fibrous Joints

Joints that are connected by dense connective tissue, consisting largely of collagen. These joints are immovable or only slightly movable, such as sutures in the skull.

Cartilaginous Joints

Joints where the bones are attached via cartilage, allowing for limited movement.

Q6: All fixed-income assets exhibit convexity in their

Q11: Open-end mutual funds<br>A)require that NAV consider the

Q30: Runoff in demand deposits in a repricing

Q35: One method of changing the positive leverage

Q40: The following is an example of a

Q41: Consider a five-year, 8 percent annual coupon

Q69: Politically motivated limitations on payments of foreign

Q74: Your U.S. bank issues a one-year U.S.

Q86: The following information is about current spot

Q100: The larger the interest rate shock, the